Ever wondered what happens if your car gets totaled, but you still owe more than it's worth? That's where State Farm gap insurance comes in. This often-overlooked coverage can save you thousands of dollars in unexpected expenses. In today's unpredictable world, having the right protection matters more than ever. Let's dive into the nitty-gritty of this crucial policy and see why it could be a game-changer for your finances.

Imagine this scenario: you just bought a shiny new car, but within a year, it gets stolen or wrecked beyond repair. Your regular insurance covers the car's current value, but what about the loan balance you still owe? That's where the gap—get it?—can hit you hard. State Farm gap insurance bridges that gap, ensuring you're not left footing the bill for a car you no longer have.

Now, I know what you're thinking—why should I care about gap insurance? Isn't my regular policy enough? Well, buckle up because we're about to break it down step by step. By the end of this guide, you'll know exactly whether State Farm gap insurance is right for you and how to make the most of it.

Read also:Ma Petite A Heartfelt Dive Into The Sweetest French Expression

What Exactly is State Farm Gap Insurance?

Let's start with the basics. State Farm gap insurance is a special type of coverage designed to protect drivers who owe more on their car loan than the vehicle's actual value. It's like an extra layer of financial security that kicks in when your regular insurance falls short. Think of it as your safety net in case life throws you a curveball.

Here's the deal: cars depreciate fast. Sometimes faster than you can blink. If your car gets totaled, your insurance might only pay out the car's current market value. But if you still owe more on the loan, that difference—the gap—can leave you in a financial pickle. That's where State Farm steps in to cover the difference.

Why Do You Need It?

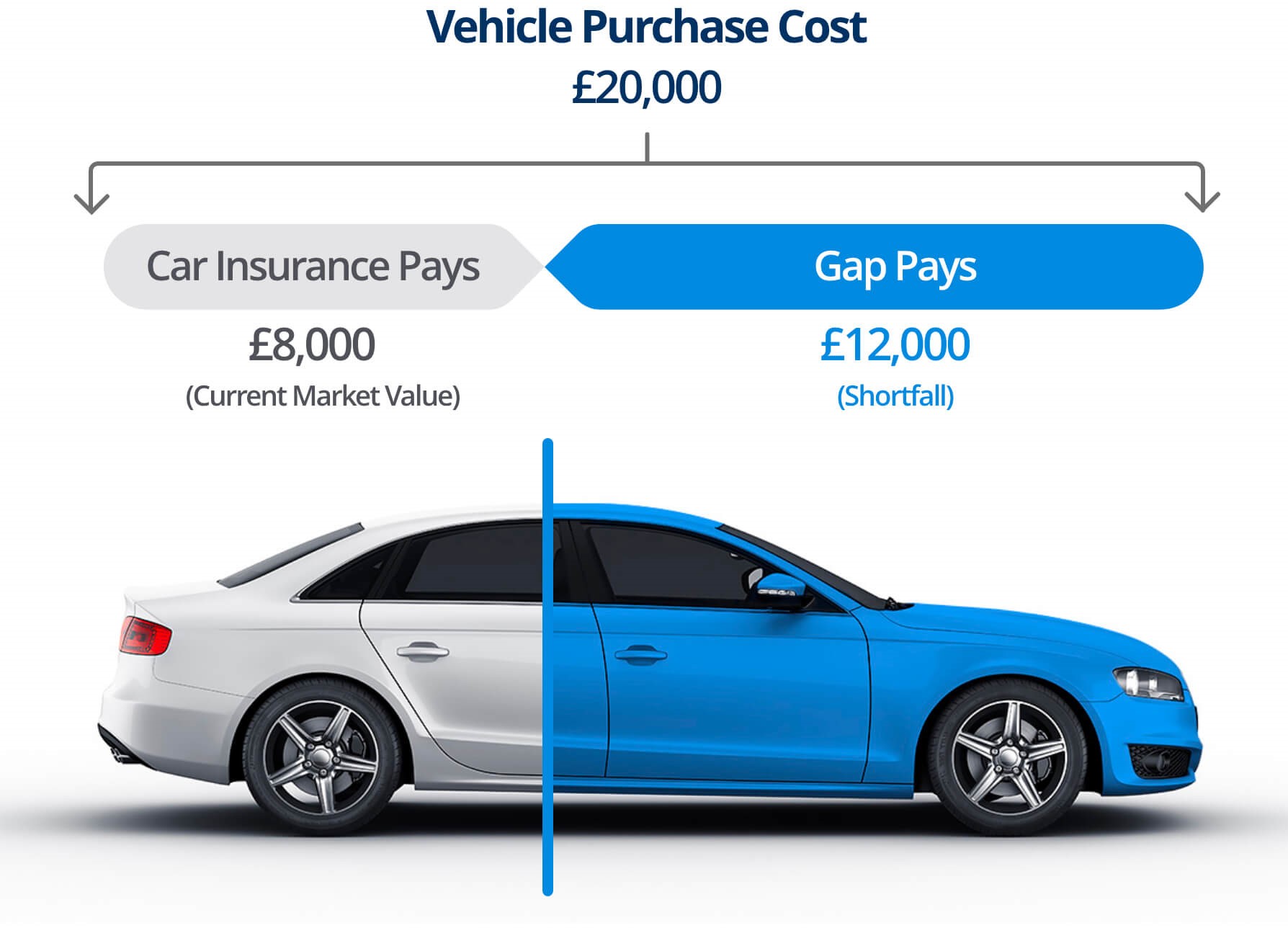

Let me paint you a picture. Say you buy a $30,000 car with a five-year loan. A year later, the car's worth drops to $20,000, but you still owe $25,000 on the loan. If something happens to the car, your regular insurance will only cover the $20,000. That leaves you stuck paying the remaining $5,000 out of pocket. Ouch, right?

But here's the kicker: State Farm gap insurance covers that $5,000 gap, so you don't have to stress about it. It's like having a financial guardian angel watching your back. And in today's economy, who couldn't use a little extra peace of mind?

How Does State Farm Gap Insurance Work?

Alright, let's get into the nitty-gritty of how this works. When you sign up for State Farm gap insurance, you're adding an extra layer of protection to your existing auto policy. If your car gets totaled or stolen, State Farm will first pay out the car's actual cash value (ACV). Then, if there's still a balance left on your loan, they'll step in to cover the difference.

For example, let's say your car's ACV is $18,000, but you owe $22,000 on the loan. State Farm will pay the $18,000 ACV and then cover the remaining $4,000 gap. It's that simple. No hidden fees, no surprises. Just straightforward coverage to keep you protected.

Read also:Nvidia Headquarters A Tech Marvel That Powers The Future

Key Features to Know

Here are some of the standout features of State Farm gap insurance:

- Covers the difference between your car's ACV and your outstanding loan balance.

- Protects you from unexpected financial burdens after an accident or theft.

- Available as an add-on to your existing State Farm auto policy.

- Simple and easy to understand, with no complicated fine print.

And the best part? State Farm makes it super easy to add this coverage to your policy. You can do it online, over the phone, or in person at a local office. It's all about convenience and peace of mind.

Who Should Get State Farm Gap Insurance?

Not everyone needs gap insurance, but for certain drivers, it's practically a no-brainer. If you fall into any of these categories, you might want to consider adding State Farm gap insurance to your policy:

- New car buyers with long-term loans (5 years or more).

- Drivers who make a small down payment on their car purchase.

- Anyone financing a car with a high interest rate.

- Drivers who lease vehicles instead of buying them outright.

Think about it: if your car depreciates faster than you can pay off the loan, you're at risk of being "upside down" on your loan. That's where State Farm gap insurance shines, giving you that extra layer of protection you need.

How Much Does It Cost?

Now, let's talk about the elephant in the room: cost. The good news is that State Farm gap insurance is typically pretty affordable. Most drivers can add it to their policy for just a few extra bucks a month. And when you consider the potential savings it could provide, it's a no-brainer.

Here's a rough estimate of what you might pay:

- $20-$30 per year for basic coverage.

- Potentially less if you bundle it with other State Farm policies.

- Exact costs vary based on factors like your location, driving history, and loan terms.

And remember, this is just an estimate. To get a personalized quote, talk to your local State Farm agent. They'll be happy to walk you through the details and help you find the best plan for your needs.

State Farm vs. Other Providers

So, how does State Farm stack up against other gap insurance providers? Let's break it down:

- Customer Service: State Farm is known for its excellent customer service, with agents available 24/7 to help you with any issues.

- Convenience: Adding gap insurance to your existing State Farm policy is quick and easy, with no need to shop around for a separate provider.

- Reputation: As one of the largest insurance companies in the U.S., State Farm has a proven track record of reliability and trustworthiness.

Of course, other providers might offer similar coverage at slightly lower rates. But when you factor in the convenience and peace of mind that come with State Farm, it's hard to beat. Plus, bundling your policies can often save you money in the long run.

Common Misconceptions About Gap Insurance

Before we move on, let's clear up a few common misconceptions about State Farm gap insurance:

- It's not just for new cars: Gap insurance can be beneficial for used car buyers too, especially if you're financing a high-value vehicle.

- It's not automatic: Contrary to popular belief, your regular auto insurance doesn't automatically include gap coverage. You need to specifically add it to your policy.

- It's not just for accidents: Gap insurance also covers theft and other covered losses, not just accidents.

Understanding these nuances can help you make a more informed decision about whether State Farm gap insurance is right for you.

How to Add State Farm Gap Insurance to Your Policy

Ready to take the plunge? Adding State Farm gap insurance to your policy is easier than you might think. Here's how you can do it:

- Log in to your State Farm account or visit a local office.

- Select the vehicle you want to add coverage to.

- Choose the gap insurance option and review your quote.

- Confirm your selection and update your policy.

And just like that, you're covered. It's that simple. Plus, if you ever decide you no longer need the coverage, you can cancel it at any time without penalty.

Tips for Getting the Best Rate

Want to make sure you're getting the best possible rate on your State Farm gap insurance? Here are a few tips:

- Bundle it with other State Farm policies for potential discounts.

- Shop around and compare quotes to ensure you're getting a fair price.

- Ask about loyalty discounts if you've been with State Farm for a while.

- Consider increasing your deductible to lower your premium.

Remember, every little bit helps when it comes to saving money on insurance. And with State Farm, you can rest assured knowing you're getting a fair and competitive rate.

Real-Life Success Stories

Let's hear from some real State Farm customers who've benefited from gap insurance:

"I was skeptical at first, but after my car was totaled in an accident, State Farm gap insurance saved me thousands of dollars. I'm so glad I added it to my policy!" – Sarah L.

"When my leased car was stolen, I thought I was out of luck. But thanks to State Farm gap insurance, I didn't have to pay a dime. It was a lifesaver!" – John D.

These stories are just a few examples of how State Farm gap insurance can make a real difference in people's lives. Don't let a financial surprise catch you off guard—get the protection you need today.

What Experts Say

According to a recent study by the National Association of Insurance Commissioners, gap insurance is becoming increasingly popular among new car buyers. "With cars depreciating faster than ever, gap insurance is a smart investment for anyone financing a vehicle," says financial expert Jane Smith. "It's a small price to pay for the peace of mind it provides."

And when it comes to choosing a provider, State Farm consistently ranks among the top choices for customer satisfaction and reliability. "Their combination of affordability and excellent service makes them a standout option," adds Smith.

Conclusion: Is State Farm Gap Insurance Right for You?

So, there you have it—the lowdown on State Farm gap insurance. Whether you're a new car buyer, a long-term leaser, or just someone looking for extra financial protection, this coverage could be exactly what you need. By bridging the gap between your car's value and your loan balance, State Farm gap insurance gives you the peace of mind you deserve.

Ready to take the next step? Visit your local State Farm office or log in to your account to add gap insurance to your policy today. And don't forget to leave a comment below letting us know what you think. Your feedback helps us create even better content for you in the future!

Table of Contents

- State Farm Gap Insurance: The Ultimate Guide for Smart Drivers

- What Exactly is State Farm Gap Insurance?

- Why Do You Need It?

- How Does State Farm Gap Insurance Work?

- Who Should Get State Farm Gap Insurance?

- How Much Does It Cost?

- State Farm vs. Other Providers

- How to Add State Farm Gap Insurance to Your Policy

- Real-Life Success Stories

- Conclusion: Is State Farm Gap Insurance Right for You?