Let’s be real here, folks. Logging into your Fifth Third Bank account shouldn’t feel like solving a puzzle. But if you’ve ever found yourself scratching your head while trying to access your account online, you’re not alone. Whether you’re a first-timer or just need a refresher, this guide is here to help you navigate the world of Fifth Third Bank log in with ease. So, grab a cup of coffee, and let’s dive into everything you need to know about getting your banking done online.

Let’s face it—life moves fast these days. Between work, family, and everything in between, who has time to physically visit a bank branch? That’s where Fifth Third Bank’s online services come in. With their user-friendly platform, you can manage your finances anytime, anywhere. But first, you need to know how to log in properly. And that’s exactly what we’ll break down for you here.

Before we get into the nitty-gritty, let’s talk about why mastering the Fifth Third Bank log in process matters. It’s more than just convenience; it’s about staying on top of your financial health. Whether you’re checking your balance, transferring funds, or paying bills, having access to your account online is a game-changer. So, let’s make sure you’re set up for success.

Read also:A Court Of Shaded Truths The Hidden Gem Of Fantasy You Didnrsquot Know You Needed

Why Fifth Third Bank Log In is a Must-Have

Alright, here’s the deal. Fifth Third Bank isn’t just another bank—it’s a powerhouse when it comes to digital banking. Their online platform offers a ton of features that make managing your money a breeze. From mobile apps to 24/7 customer support, they’ve got you covered. But why should you care about logging in? Well, let me break it down for you.

First off, logging in gives you access to all your account details in one place. Need to check your balance? Done. Want to pay a bill? Easy peasy. Plus, you can set up automatic payments, monitor transactions, and even apply for loans—all from the comfort of your couch. And let’s not forget about security. Fifth Third Bank uses top-notch encryption to keep your info safe, so you can bank with peace of mind.

What Makes Fifth Third Bank Stand Out?

Let’s be honest—there are tons of banks out there. So, what makes Fifth Third Bank different? For starters, they’ve been around for over 150 years, so they know a thing or two about banking. Their commitment to innovation means they’re always improving their digital services to meet the needs of modern customers. Whether you’re a tech-savvy millennial or someone who’s just dipping their toes into online banking, Fifth Third Bank has something for everyone.

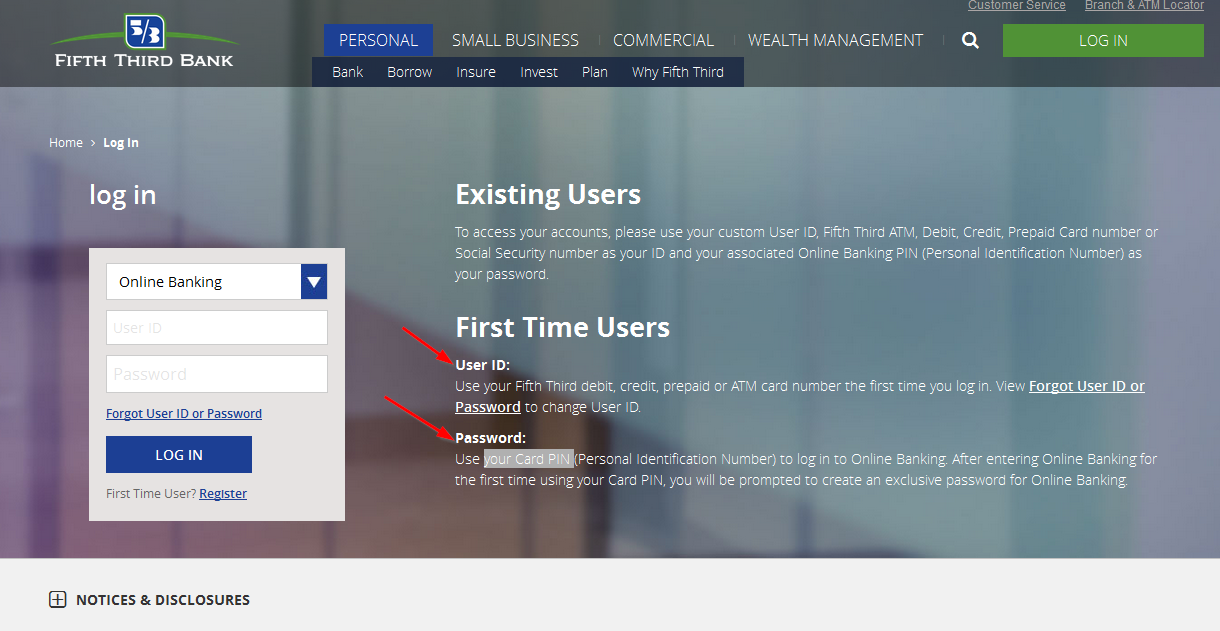

Step-by-Step Guide to Fifth Third Bank Log In

Alright, let’s get down to business. Logging into your Fifth Third Bank account doesn’t have to be complicated. Follow these simple steps, and you’ll be good to go:

- Head over to the Fifth Third Bank website at www.53.com.

- Click on the “Log In” button located at the top right corner of the page.

- Enter your username and password in the fields provided.

- Hit “Submit” and voilà—you’re in!

But wait, what if you don’t have an account yet? No worries. We’ve got you covered in the next section.

Troubleshooting Common Log In Issues

Let’s talk about some common issues people run into when trying to log in to Fifth Third Bank. One of the biggest headaches is forgetting your username or password. If that happens, don’t panic. Just click on the “Forgot Username/Password” link, and you’ll be guided through the process of resetting it. Another issue could be technical glitches. If the site isn’t loading properly, try clearing your browser cache or using a different device.

Read also:Jessy Schram Rising Star In The Entertainment World

Creating a Fifth Third Bank Account: The Basics

So, you’re ready to join the Fifth Third Bank family. Great choice, by the way. Creating an account is super simple. All you need is some basic info, like your Social Security number, address, and a valid ID. Once you’ve gathered everything, follow these steps:

- Visit the Fifth Third Bank website and click on “Open an Account.”

- Choose the type of account you want to open—whether it’s a checking, savings, or money market account.

- Fill out the application form with your personal details.

- Submit your application, and you’ll be on your way to financial freedom in no time.

What to Expect After Creating Your Account

Once you’ve successfully created your account, you’ll receive a confirmation email with all the details you need to get started. You’ll also be able to set up your online banking credentials, including your username and password. And don’t forget to download the Fifth Third Bank app for easy access on the go.

Security Features to Protect Your Account

Security is a big deal when it comes to online banking. Fifth Third Bank understands this and has implemented several features to keep your account safe. Here’s what you can expect:

- Two-Factor Authentication: This adds an extra layer of security by requiring a second form of verification, like a text message code, before you can access your account.

- Encryption Technology: Your data is encrypted both in transit and at rest, ensuring that no one can intercept your sensitive information.

- Account Alerts: Stay in the loop with real-time alerts for suspicious activity or large transactions.

Tips for Staying Safe Online

While Fifth Third Bank does its part to keep your account secure, there are a few things you can do to help. Always use strong, unique passwords and avoid logging in on public Wi-Fi networks. Also, keep an eye on your account activity and report any suspicious transactions immediately.

Exploring Fifth Third Bank’s Mobile App

Let’s talk about the Fifth Third Bank mobile app. It’s like having your bank in your pocket. With the app, you can do pretty much everything you can do on the website—plus a few extras. For instance, you can deposit checks using your phone’s camera, transfer money instantly, and even locate the nearest ATM. And the best part? It’s available 24/7, so you can bank whenever it’s convenient for you.

Downloading and Setting Up the App

Ready to get started with the Fifth Third Bank app? Here’s how:

- Head to the App Store (for iOS) or Google Play Store (for Android).

- Search for “Fifth Third Bank” and download the app.

- Open the app and log in using your online banking credentials.

- Customize your settings and start exploring all the features.

Customer Support: Your Backup Plan

Let’s face it—sometimes things go wrong. Whether you’re having trouble logging in or just need some advice, Fifth Third Bank’s customer support team is here to help. You can reach them via phone, email, or live chat. Plus, they offer a knowledge base with answers to frequently asked questions, so you might find what you’re looking for without even having to pick up the phone.

How to Contact Fifth Third Bank

Need to get in touch with Fifth Third Bank? Here’s how:

- Phone: Call their customer service hotline at 1-800-533-4226.

- Email: Send an email through the contact form on their website.

- Live Chat: Use the live chat feature on the Fifth Third Bank website for instant assistance.

Final Thoughts: Taking Control of Your Finances

There you have it, folks. Everything you need to know about Fifth Third Bank log in and beyond. Whether you’re logging in for the first time or just looking to brush up on your skills, remember that online banking is all about convenience and security. By following the steps we’ve outlined, you’ll be well on your way to managing your finances like a pro.

Now, here’s the fun part. Take action! If you haven’t already, head over to the Fifth Third Bank website and start exploring all the amazing features they offer. And don’t forget to share this article with your friends and family who might find it useful. Together, let’s make banking easier and more accessible for everyone.

Table of Contents

- Why Fifth Third Bank Log In is a Must-Have

- Step-by-Step Guide to Fifth Third Bank Log In

- Troubleshooting Common Log In Issues

- Creating a Fifth Third Bank Account: The Basics

- Security Features to Protect Your Account

- Exploring Fifth Third Bank’s Mobile App

- Customer Support: Your Backup Plan

- Final Thoughts: Taking Control of Your Finances