Let’s face it, folks—managing your finances can be a real headache. But don’t worry, because today we’re diving deep into the world of Chase check books. Whether you’re a seasoned money manager or just starting out, this guide is packed with everything you need to know about Chase check books. So, grab a cup of coffee (or maybe a cocktail), and let’s get started!

When it comes to financial tools, Chase check books are like the unsung heroes of the banking world. They may not have the glitz and glamour of mobile apps or digital wallets, but they’re reliable, practical, and downright essential for certain transactions. If you’re wondering what makes them so special, stick around—we’ve got all the answers.

Now, before we dive into the nitty-gritty, let’s set the stage. A Chase check book is more than just a bunch of papers with your name on them. It’s a tool that gives you control over your money, helps you track expenses, and ensures you’re always prepared for those moments when cash or cards just won’t cut it. Ready to learn more? Let’s go!

Read also:How To Master Wa Web Login The Ultimate Guide

What Exactly is a Chase Check Book?

Alright, let’s break it down. A Chase check book is essentially a collection of personalized checks issued by Chase Bank. Each check includes your account details, such as your name, account number, and routing number. These checks allow you to make payments, transfer funds, or pay bills directly from your Chase account. Think of it as a physical extension of your bank account.

But why would you need one in this digital age? Well, here’s the deal: not every business accepts electronic payments, and some transactions—like paying rent, sending money to family, or even buying a car—require a good old-fashioned check. That’s where Chase check books come in handy.

Why Should You Get a Chase Check Book?

There are plenty of reasons to consider getting a Chase check book. For starters, they’re super convenient for situations where cash or cards aren’t accepted. Plus, they give you a paper trail of your transactions, which can be super helpful when it comes to budgeting or resolving disputes. Here’s a quick rundown of the benefits:

- Easy to order through Chase’s online platform or mobile app.

- Customizable designs to match your personal style.

- Secure and reliable for sensitive transactions.

- Helps you keep track of your spending habits.

- Perfect for those who prefer a tangible way to manage their finances.

How to Order a Chase Check Book

Ordering a Chase check book is easier than you might think. Whether you’re a tech-savvy millennial or someone who prefers the good old-fashioned way, Chase has got you covered. Here’s how you can get your hands on one:

Step 1: Log in to Your Chase Account

Head over to Chase’s website or fire up their mobile app. Once you’re logged in, navigate to the section where you can order checks. It’s usually under “Account Services” or something similar.

Step 2: Choose Your Design

Chase offers a variety of check designs, from classic and professional to fun and quirky. Take your pick, and don’t be afraid to express your personality. After all, who says finance can’t be stylish?

Read also:The Story Of The Fattest Person A Journey Of Health Challenges And Resilience

Step 3: Confirm Your Details

Double-check everything before finalizing your order. Make sure your name, account number, and routing number are correct. Trust me, you don’t want to deal with the hassle of fixing mistakes later.

Step 4: Wait for Your Check Book to Arrive

Once you’ve placed your order, sit back and relax. Chase typically ships check books within a few business days, so you’ll have them in no time. And hey, if you’re impatient, you can always swing by a Chase branch to pick them up in person.

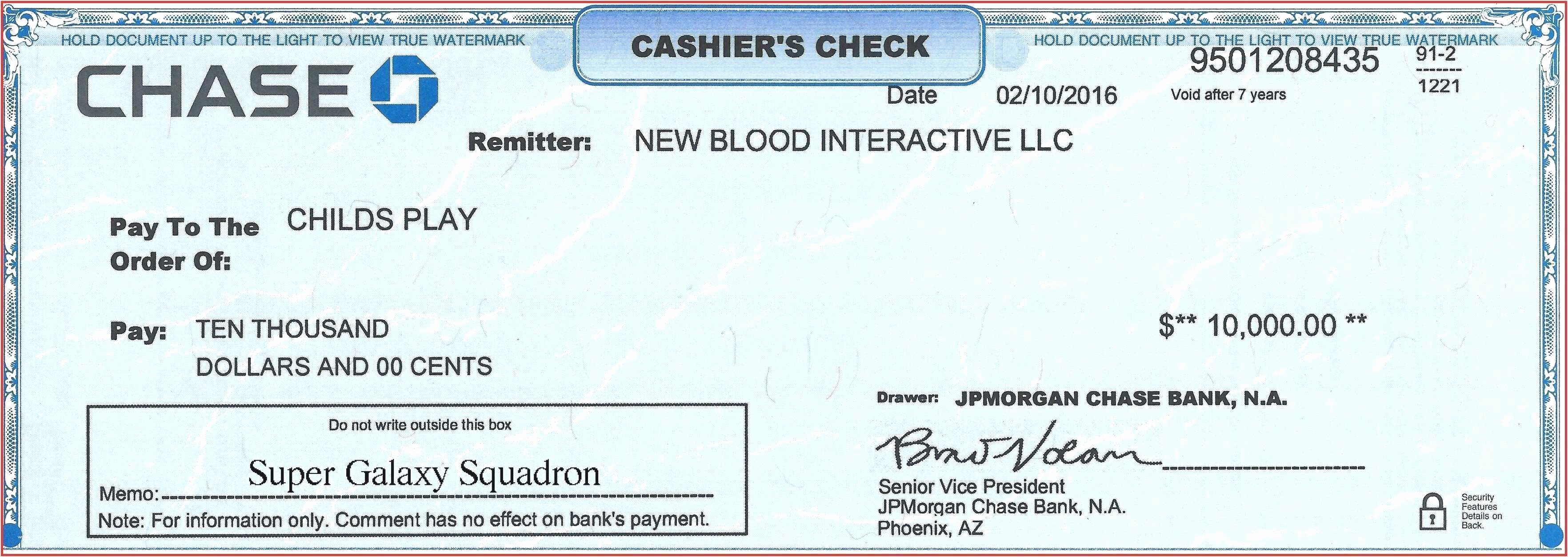

Understanding the Components of a Chase Check

Each check in your Chase check book is packed with important information. Let’s break it down so you know exactly what you’re working with:

- Your Name: This is pre-printed on the check for security purposes.

- Account Number: This identifies your specific Chase account.

- Routing Number: This is used to direct payments to the correct bank.

- Date Line: Fill this in with the date you’re writing the check.

- Payee Line: This is where you write the name of the person or business you’re paying.

- Amount Box: Enter the payment amount in numerical form here.

- Amount Line: Write out the payment amount in words for clarity.

- Signature Line: Sign your name here to authorize the payment.

- Memo Line: Use this space to add notes or reference numbers if needed.

Common Questions About Chase Check Books

Let’s address some of the most frequently asked questions about Chase check books. Odds are, if you’re wondering about something, someone else has probably asked the same thing.

Q: Can I Customize My Chase Check Book?

Absolutely! Chase offers a range of customization options, from colors and fonts to images and graphics. You can even upload your own photos if you’re feeling extra creative. Just remember to keep it professional if you’ll be using the checks for work-related purposes.

Q: How Long Does It Take to Receive My Check Book?

Typically, Chase check books arrive within 7-10 business days. However, this can vary depending on your location and the shipping method you choose. If you’re in a rush, consider picking them up at a local Chase branch.

Q: Are Chase Checks Secure?

Yes, Chase checks come with several security features to prevent fraud. These include watermarks, security threads, and special inks that change color when exposed to heat or light. Always keep your checks in a safe place to avoid any mishaps.

Tips for Using Your Chase Check Book

Now that you’ve got your shiny new Chase check book, here are a few tips to help you use it effectively:

- Always keep your check book in a secure location to prevent theft or loss.

- Regularly review your checkbook register to ensure all transactions are accurate.

- Use the memo line to note the purpose of each check, making it easier to track expenses later.

- Consider setting up direct deposit for recurring payments to save time and hassle.

- Be mindful of your account balance to avoid bouncing checks or incurring fees.

Chase Check Book vs. Other Payment Methods

With so many payment options available today, you might be wondering how Chase check books stack up against the competition. Here’s a quick comparison:

Pros of Chase Check Books

- Accepted by most businesses and individuals.

- Provides a paper trail for transactions.

- Easy to order and customize.

- Secure and reliable for sensitive payments.

Cons of Chase Check Books

- Can take longer to process than electronic payments.

- Requires manual effort to write and mail checks.

- May not be accepted by all merchants.

How to Stay Safe When Using Chase Checks

Security is key when it comes to managing your finances. Here are a few tips to help you stay safe while using your Chase check book:

- Never give out your account or routing number unless absolutely necessary.

- Shred old checks and statements to protect sensitive information.

- Monitor your account regularly for any suspicious activity.

- Report lost or stolen checks immediately to prevent fraud.

Conclusion: Why Chase Check Books Are Still Relevant

So there you have it—everything you need to know about Chase check books. Despite the rise of digital payment methods, checks remain an essential tool for managing your finances. They offer security, convenience, and peace of mind, making them a valuable asset in your financial toolkit.

Now that you’re armed with knowledge, it’s time to take action. Whether you’re ordering your first Chase check book or looking to improve your check-writing habits, remember that every step counts when it comes to financial management.

And hey, don’t forget to share this article with your friends and family. Who knows? You might just help someone else discover the power of Chase check books. Until next time, stay sharp and keep those finances in check!

Table of Contents

- What Exactly is a Chase Check Book?

- Why Should You Get a Chase Check Book?

- How to Order a Chase Check Book

- Understanding the Components of a Chase Check

- Common Questions About Chase Check Books

- Tips for Using Your Chase Check Book

- Chase Check Book vs. Other Payment Methods

- How to Stay Safe When Using Chase Checks

- Conclusion: Why Chase Check Books Are Still Relevant